Addressing Climate Change

- Basic Approach to Climate Change

- Information Disclosure Based on TCFD Recommendations

- Initiatives to reduce and control CO2 emissions

Addressing climate change is an important management priority for the Group, and we promote environmental management by taking actions such as reducing greenhouse gas emissions to contribute to the realization of a sustainable society.

Basic Approach to Climate Change

Glory's Environmental Policies address global warming and set forth the Group's 2050 environmental goals to achieve carbon neutrality by 2050 (i.e., net zero in Scope 1 and 2). Specifically, we aim to reduce CO2 emissions in our business activities and environmental impact in our value chain towards a net zero society.

Information Disclosure Based on TCFD Recommendations

Since November 2021, the Glory group has supported the TCFD* recommendations, based on which we will enhance our climate-related disclosure as we make progress on the initiatives taken.

* Task Force on Climate-related Financial Disclosures

Governance

Reducing greenhouse gas emissions is one of the most important material issues for the Glory Group, and we aim to reduce environmental impact in all aspects of our business operations towards building a sustainable society.

Climate change-related issues are discussed by the Environmental Management Committee, met twice a year and chaired by the environmental management officer appointed by the Board. The important matters decided upon by the Environmental Management Committee and implementation of initiatives are reported to and approved by the Sustainability Committee which meets twice a year and is chaired by the President. The Sustainability Committee regularly reports to the Board, ensuring appropriate decision-making and monitoring concerning the Group's sustainability management.

Strategies

Below is a list of material climate-related risks and opportunities for the Glory Group's business, with key drivers and possible financial impacts over medium- to long-term.

As a practice, analyze business and financial impacts of each risk identified based on the IPCC*1 and IEA*2 scenarios shown below to formulate and implement countermeasures.

As in the previous year, we used the following two scenarios, with reference to the examples of typical risks and opportunities by the TCFD:

1.5/2℃ scenario: Climate change measures are implemented in line with the goals of the Paris Agreement

Introduction of carbon tax would increase our business costs with a medium to large financial impact. On the other hand, energy price fluctuations (e.g., electricity, gas, and gasoline) may decrease our business costs with a small financial impact.

4℃ scenario: Climate change measures are not implemented and consequences become a reality

River flooding and storm surges can damage production/logistics sites and cause business/operational shutdowns. This would generate recovery costs or/and reduce profits, however, financial impact is expected to be small.

| Risks & Opportunities | Key Drivers | Business Impacts |

Time horizon*4 | Financial Impacts*5 |

Countermeasures | ||

|---|---|---|---|---|---|---|---|

| Category | Item | 1.5℃ scenario |

4℃ scenario |

||||

| Transition Risks |

Government Policies & Regulations |

Introduction of carbon tax | Increase in business costs due to carbon tax | Medium Term | [Medium] Increase in cost |

|

|

| Long Term | [Large] Increase in cost |

[Medium] Increase in cost |

|||||

| Broadened scope and increased complexity of applicable laws and regulations | Increase in costs associated with laws and regulations | Short - Long Term | [Medium] Increase in cost |

|

|||

| Technology | Growing market demand for energy-saving products and services | Increase in research and development costs to maintain market competitiveness | Medium - Long Term | [Medium] Increase in cost |

Develop technologies and products based on market and industry trends | ||

| Decreased sales due to delays in the development of environmentally friendly products | [Medium] Decrease in sales |

||||||

| Market | Rising raw material costs | Fluctuations in energy prices (electricity, gas, gasoline, etc.) | Medium Term | [Medium] Decrease in cost |

[Medium] Increase in cost |

Improve renewable energy ratio | |

| Long Term | [Medium] Decrease in cost |

[Medium] Increase in cost |

|||||

| Reputation | Increasing demand from stakeholders for decarbonization (rising social demand for the reduction of greenhouse gas emissions) | Deterioration of investors' decisions due to insufficient decarbonization efforts and information disclosure by the company | Short - Long Term | [Large] Decrease in corporate value |

Execute medium- to long-term environmental plans and promote fair and proactive disclosure of ESG initiatives | ||

| Impact on reputation and sales due to delays in responding to external requests | [Large] Decrease in sales |

Appropriate information disclosure based on customer requests and ESG disclosure standards | |||||

| Risks & Opportunities | Key Drivers | Business Impacts |

Time Horizon*4 | Financial Impacts*5 |

Countermeasures | ||

|---|---|---|---|---|---|---|---|

| Category | Item | 2℃ scenario |

4℃ scenario |

||||

| Physical Risks |

Acute | Intensification of natural disasters | Losses due to suspension of business operation caused by damage to our own factories or employees (e.g., typhoons and floods) | Medium Term | [Small] Decrease in sales |

|

|

| Long Term | [Small] Decrease in sales |

||||||

| Increase in costs for repair and replacement of damaged facility/equipment (e.g., High tide and flood) | Medium Term | [Small] Increase in cost |

|||||

| Long Term | [Small] Increase in cost |

||||||

| Parts procurement disruption due to suppliers being inoperable | Short - Long Term | [Small] Decrease in sales |

|||||

| Chronic | Sea level rise | Operational shutdown at low-altitude production and distribution sites | Medium - Long Term | [Small] Decrease in sales |

|||

| Average temperature rise | Increase in operating costs due to additional load on air conditioning equipment | Short - Long Term | [Small] Increase in cost |

Implement energy-saving measures and install energy-efficient air conditioning equipment | |||

| Opportunities | Products & Services |

Growing demand for environmentally friendly products | Increase in sales in response to the growing demand for environmentally friendly products | Medium - Long Term | [Large] Increase in sales |

Develop environmentally friendly products | |

| Growing demand for low-carbon services and solutions | Increase in sales through creation of DX businesses that contribute to CO2 emissions reduction | Medium - Long Term | [Large] Increase in sales |

Develop and promote DX businesses in new domains, such as self-service, remote customer service, and unmanned store solutions | |||

*1 IPCC: Intergovernmental Panel on Climate Change

*2 IEA: International Energy Agency

*3 Adopted Scenarios

| Evaluation Content | Adopted Scenarios |

|---|---|

| Carbon taxes, energy prices | IEA WEO2022: NZE, APS, STEPS |

| Natural disasters | IPCC AR6: RCP2.6, RCP4.5, RCP8.5 |

*4 Time Horizon

| Classification | Period | Notes |

|---|---|---|

| Short-term | Up to FY2026 | Period of the Glory Group's 2026 Medium-Term Management Plan |

| Medium-term | Up to FY2030 | Medium-Term Environmental Targets have been set up to FY2030 |

| Long-term | Up to FY2050 | Long-term environmental goals have been set toward net zero by 2050 |

*5 Definition of financial impact

| Evaluation results | Amount affected |

|---|---|

| Large | 1 billion yen or more |

| Medium | Between 100 million and 1 billion yen |

| Small | Less than 100 million yen |

Risk management

The Risk Management Committee, chaired by the Company’s President, is responsible for risk management concerning the Group's business. Climate-related risks are managed in accordance with the Environmental Management System (EMS).

Metrics & Targets

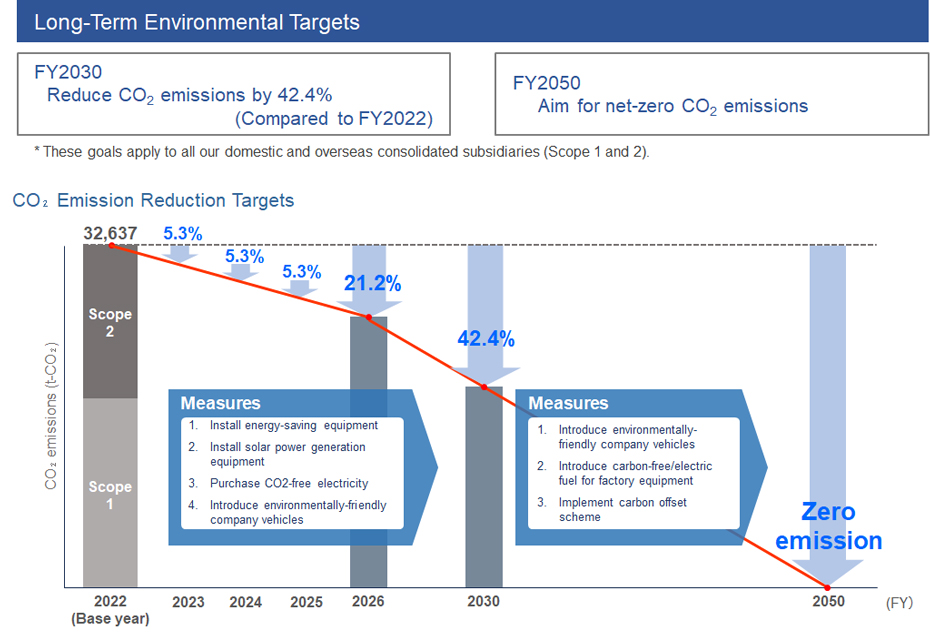

Using CO2 emissions as an indicator to manage climate change-related risks and opportunities, we have set the 2050 Environmental Targets to achieve carbon neutrality by fiscal 2050 (net-zero CO2 emissions for Scope 1 and 2), then casting back, set the 2030 Environmental Targets as a closer milestone.

In April 2024, to make our CO2 emissions reduction initiatives more global and robust, we expanded the scope of CO2 emissions (Scope1 and 2) reporting to include overseas consolidated subsidiaries, and revised our targets in line with the certification standards of the Science Based Targets initiatives (SBTi). In addition, we have submitted a commitment letter toward obtaining SBT certification in November 2025.

In practice, we continue to install energy-saving equipment at production sites, increase the use of renewable energy through solar power generation, purchase CO2-free electricity, and switch to environmentally-friendly company cars.

We have also our FY2030 Scope 3 reduction targets to aim for net zero CO2 emission across our value chain.

*An initiative by the UN Global Compact, CDP (a coalition of institutional investors that promotes the disclosure of information on climate change measures), WRI (World Resources Institute), and WWF (World Wide Fund for Nature). The initiative encourages companies to set reduction targets that are consistent with scientific knowledge, with a view to limiting the increase in global average temperature due to climate change to 1.5 degrees celsius above pre-industrial revolution levels.

Initiatives to reduce CO2 emissions

Scope 1 and 2 emissions

The Glory Group implements global initiatives towards its “2050 Environmental Goals” that aims for target carbon neutrality (net zero CO2 emissions for Scope 1 and 2) by fiscal 2050. Currently, we are introducing energy-saving air conditioning systems and LED lighting, expanding the use of renewable energy through solar power generation, and switching to 100% renewable energy-derived, CO2-free electricity.

Through these initiatives, we have achieved net zero CO2 emissions from electricity at our major domestic locations (Himeji Head Office/Factory and Saitama Factory) in fiscal 2024.

Scope 3 emissions

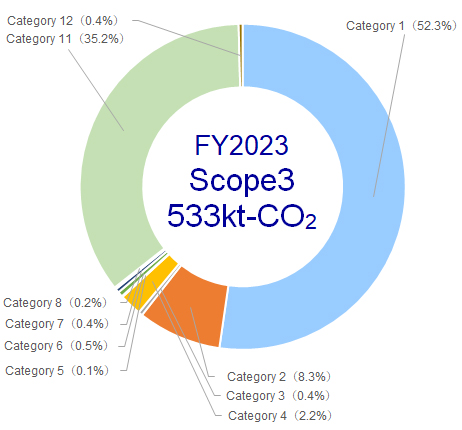

Scope 3 accounts for approx. 93% of the Group's total CO2 emissions, and Category 1 (CO2 emissions during the manufacture of purchased goods and services) and Category 11 (CO2 emissions during use of sold products & services) account for approx. 86% of Scope 3. We therefore focus on Category 1 and 11 to promote CO2 reduction initiatives to lower the environmental impact across our value chain. For Category 1, we engage our primary first tier suppliers to agree on CO2 reduction targets, and for Category 11, we aim to improve energy efficiency by thorough product assessments during product development.

Scope 3

Category 1: Purchased goods and services

Category 2: Capital goods

Category 3: Fuel and energy-related activities not included in Scope 1 or 2

Category 4: Upstream transportation and distribution

Category 5: Waste generated in operations

Category 6: Business travel

Category 7: Employee commuting

Category 8: Upstream leased assets

Category 11: Use of sold products

Category 12: End-of-life treatment of sold products

*Category 9, 10, 13, 14 and 15 are not applicable to our business.