Stock Information

Stock Information (as of March 31, 2024)

| Number of shares authorized | 150,000,000 |

|---|---|

| Number of shares issued | 58,938,210 (Including 2,873,306 shares of treasury stock) |

| Number of shareholders | 16,293 |

| Fiscal year End | March 31 |

| Date of Ordinary General Meeting of Shareholders | Late June |

| Record Dates | Ordinary General Meeting of Shareholders: March 31 Year-end dividend: March 31 Interim dividend: September 30 Other such events are conducted from time to time upon sufficient notice to shareholders. |

| Trading unit | 100 shares |

| Listing | Tokyo Stock Exchange, Prime Market |

| Securities Code | 6457 |

| Method of Public Notices | The Company's method of giving public notice is by electronic notice. However, if the Company is unable to give public notice by electronic means due to an accident or other unavoidable circumstances, the same will be made by publishing in the Nikkei. https://www.glory.co.jp |

| Administrator of Shareholder Registry | Mitsubishi UFJ Trust and Banking Corporation |

Major Shareholders

| Shareholder | Number of shares held (Thousands of shares) |

Holding ratio(%) |

|---|---|---|

| The Master Trust Bank of Japan, Ltd. (Trust account) | 7,558 | 13.5 |

| Nippon Life Insurance Company | 3,427 | 6.1 |

| Glory Group Employees' Stock Ownership Association | 2,602 | 4.6 |

| Custody Bank of Japan, Ltd. (Trust account) | 2,156 | 3.8 |

| Tatsubo Fashion Co. Ltd. | 1,500 | 2.7 |

| Glory Business Partners' Stock Ownership Association | 1,113 | 2.0 |

| Sumitomo Mitsui Banking Corporation | 1,100 | 2.0 |

| MUFG Bank, Ltd. | 879 | 1.6 |

| THE BANK OF NEW YORK MELLON 140044 | 848 | 1.5 |

| TATSUTA BOUSEKI CO.,LTD. | 726 | 1.3 |

* The Company holds 2,873,306 treasury shares, however, they are not included in the above list.

* Percentage of total issued shares is calculated by excluding the Company's treasury shares.

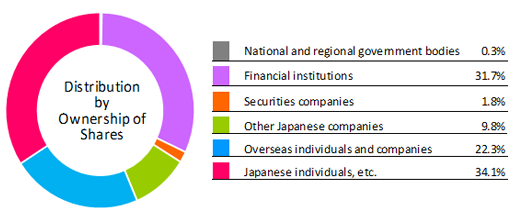

Shareholder Distribution

The Articles of Incorporation

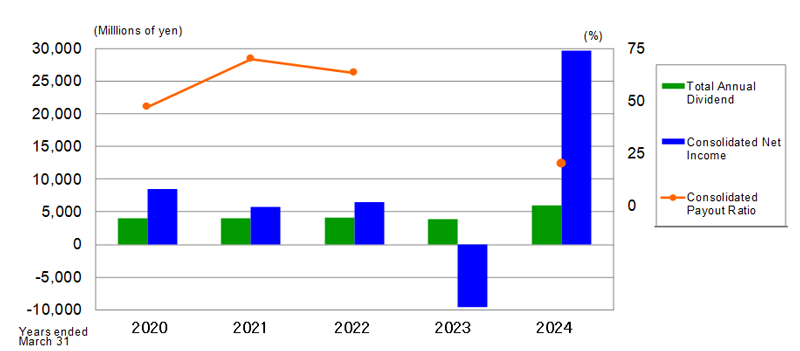

Dividend Information

GLORY LTD. (the "Company") considers the return of profits to shareholders to be an important management task and retain a policy to continue stable dividends while striving to maintain and enhance a sound financial position in preparation for future business growth. In the three fiscal years of the 2026 Medium-Term Management Plan (from the fiscal year ending March 31, 2025 to the fiscal year ending March 31, 2027), which began in April 2024, in addition to following the Company's basic policy of “continuing stable dividends while investing in future business growth and maintaining financial strength,” we have set a target of “progressive dividends, based on the annual dividend for the fiscal year ended March 31, 2024 (annual dividend of ¥106 per share), and dividends on shareholders' equity (DOE) of 3% or more” and aim to increase dividends in a stable and continuous manner.

With regard to the future purchase of treasury shares, the Company will take the best approach, considering future business development, investment plans, the internal reserves, and performance trends. The Company’s policy is to keep treasury shares within approximately 5% of total shares issued by retiring any treasury shares in excess of that amount.

| Dividends Per Share (Yen) | Time of Payment | |||

|---|---|---|---|---|

| Interim (Forecast) |

Year-End (Forecast) |

Annual (Forecast) |

Interim | Year-End |

| 54 | 54 | 108 | December 2024 | June 2025 |

| 2020 | 2021 | 2022 | 2023 | 2024 | |||

|---|---|---|---|---|---|---|---|

| Net income attributable to owners of parent (Millions of Yen) |

8,486 | 5,705 | 6,410 | -9,538 | 29,674 | ||

| Dividends Per Share (Yen) | Interim | 32 | 30 | 34 | 34 | 40 | |

| Year-End | 34 | 36 | 34 | 34 | 66 | ||

| Annual | 66 | 66 | 68 | 68 | 106 | ||

| Total Annual Dividend (Millions of Yen) | 4,010 | 4,010 | 4,132 | 3,855 | 5,942 | ||

| Consolidated Payout Ratio (%) | 47.0 | 69.9 | 63.2 | - | 19.9 | ||

The consolidated payout ratio for FY2022 is not stated as it is a net loss.

Adobe Reader