Corporate Governance

- Basic Policy

- Corporate Governance Framework

- Corporate Governance Guidelines

- Outline of Main Organs

- Remuneration for Directors

- Policy for Training of Directors

- Corporate Governance Report

- Evaluation on Effectiveness of the Board of Directors

Basic Policy

Based on our “Corporate Philosophy,” which embodies our determination to grow as a sustainable enterprise by contributing to a prosperous society through our commitment to product development, the Company and its subsidiaries (collectively, the “Group”) aim to improve the corporate value by striving to exist in harmony with society and promoting sound and efficient corporate management that is trusted and supported by all stakeholders.

To this end, we strive to improve corporate governance thus further improve our corporate value, through enhanced supervisory and executive functions of management, expedited, transparent, and objective decision-making, and enhanced compliance management.

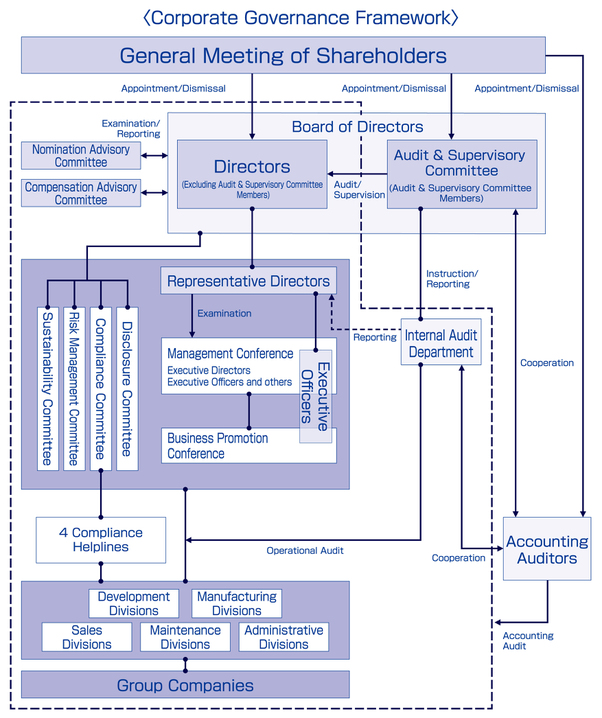

Corporate Governance Framework

Glory has adopted a “Company with Audit & Supervisory Committee” as a form of corporate organization to further strengthen the supervisory function of the Board of Directors and increase the efficiency of management decision-making.

For further enhancement of the supervisory function of the Board and for swift and efficient business management, decisions regarding the execution of important operations are flexibly delegated to Directors and business execution function of management are delegated to an executive officer upon the executive officer system.

Furthermore, the Company has established committees such as the Nomination Advisory Committee and the Compensation Advisory Committee as consultative bodies for the determination of appointment and remuneration to ensure the transparency and objectivity of management decision-making while the Audit & Supervisory Committee addresses to enhance the audit and supervisory functions.

Glory’s basic policy on corporate governance is set out in the Corporate Governance Guidelines.

Corporate Governance Guidelines

Outline of Main Governing Bodies

The Company’s Board of Directors is composed of eleven (11) Directors, eight (8) of which are Directors who are not Audit & Supervisory Committee Members and three Directors who are Audit & Supervisory Committee Members, including five independent Outside Directors. The Board decides on the important business policies of the Group, and supervises and receives reports on the business execution, in accordance with the Rules of the Board of Directors. To enable expedited decision-making, the authority regarding decisions on execution of important operations is delegated to the Directors as necessary.

In FY2023, the Board of Directors met 17 times and made necessary resolutions and received reports on the status of business execution. Major agenda items in FY2023 included progress of the 2023 Medium-Term Management Plan and discussions for the next medium-term management plan, M&As and post-investment monitoring, internal controls, Board effectiveness evaluation, procurement difficulties and geopolitical risks, and discussions on sustainability initiative.

The Company’s Audit & Supervisory Committee is composed of three (3) Directors who are Audit & Supervisory Committee Members, including two independent Outside Directors. The Company ensures that the Audit & Supervisory Committee with a full-time committee member and a chairperson therein. The chairperson who is a full-time committee member presides over its meetings. The Audit & Supervisory Committee works closely with the Company’s Internal Audit Department positioned thereunder and the accounting auditor to conduct audits based on the committee’s annual corporate audit plan in accordance with the audit policy and the assignment of duties determined thereby.

The Audit & Supervisor Committee Members meet once per month in principle to deliberate on the status and results of audits.

The two Outside Directors who are Audit & Supervisory Committee Members apply their extensive knowledge and experience in audits and supervisions of the Company’s management to ensure legitimacy and adequacy.

Mr. Keiichi Kato, Outside Director, is an attorney-at-law who possesses extensive experience regarding corporate legal affairs and Ms. Yukako Ikukawa, Outside Director and Certified Public Tax Accountant, possess considerable expertise in finance and accounting. Their experience and expertise contribute to the effectiveness of audits and enhance the Board’s supervision in enhancing legitimacy and adequacy in the Company’s management.

Moreover, the Company assigns two employees to assist in the execution of duties of the Audit & Supervisory Committee for further effective auditing.

The Audit & Supervisory Committee and the Company’s accounting auditors work closely to enhance the efficiency and effectiveness of audits. In addition to regular meetings held several times a year, they meet as required to ensure appropriateness and credibility in their execution of duties. This is achieved through such measures as briefing, consultation or inquiries, and confirmation on matters that require special attention, regarding the annual audit plans and site audit plans (including audits of consolidated subsidiaries) prepared at the beginning of each fiscal year.

Further, Audit & Supervisory Committee works closely with the Internal Audit Department positioned thereunder to enhance efficiency and effectiveness of the audits. Each time the Internal Audit Department conducts an audit pursuant to the annual audit plan, Audit & Supervisory Committee Members receive the copies of the audit notification from the Internal Audit Department and confirm such matters as schedule, subject, purpose, method and other matters of the relevant audit stated therein. After completion of the audit, Audit & Supervisory Committee Members receive an internal audit report concerning matters pointed out and the status of improvement, upon which they discuss and exchange opinions with the Internal Audit Department personnel.

In addition, the general manager of the Internal Audit Department reports to the committee quarterly on results of internal audits and other important matters for discussion, reports to the President & Representative Director on a monthly basis, and meet with the accounting auditor regularly and as necessary for discussion.

The Company has established a Nomination Advisory Committee to ensure transparency and objectivity concerning the nomination of directors. As required by the Board of Directors, the Nomination Advisory Committee deliberates on the nomination of candidates for Directors and Executive Officers, the selection of senior management executives, and the planning for their successors.

In FY2023, the committee met seven (7) times to deliberate on matters including appointment process for Directors, election and interviews of candidates for Directors and Executive Officers, succession planning, and revision of the Company's Executive Officer System.

The Company has established a Compensation Advisory Committee to ensure transparency and objectivity in determining remuneration for Directors and Executive Officers. As required by the Board, the Compensation Advisory Committee deliberates and reports to the Board on the fairness of the amount, structure and decision-making process in relation to remuneration consisting of fixed compensation, bonuses and stock compensation.

In FY2023, the committee met five (5) times to deliberate on matters including the amount of Fixed Compensation for Directors and Executive Officers, target values, formulas, and the amount calculated for Bonuses, and points to be awarded under the Stock Compensation Plan, and revision of officers' remuneration system.

<Members of main governing bodies>

| Title | Name | Board of Directors |

Audit & Supervisory Committee

|

Nomination Advisory Committee | Compensation Advisory Committee |

|---|---|---|---|---|---|

| Chairman of the Board & Representative Director | Motozumi Miwa | ○ | |||

|

President &

Representative Director |

Akihiro Harada | ◎ | ○ | ○ | |

| Executive Vice President & Director |

Hideo Onoe | ○ | |||

| Director | Kaname Kotani | ○ | |||

| Director | Tomoko Fujita | ○ | |||

| Outside Director | Joji Iki | ○ | ◎ | ○ | |

| Outside Director | Ian Jordan | ○ | |||

| Outside Director | Ikuji Ikeda | ○ | ○ | ◎ | |

| Director (Audit & Supervisory Committee Member) |

Masato Inuga | ○ | ◎ | ||

| Outside Director (Audit & Supervisory Committee Member) |

Keiichi Kato | ○ | ○ | ||

| Outside Director (Audit & Supervisory Committee Member) |

Yukako Ikukawa | ○ | ○ |

"◎" in the above table shows chairperson of each committee.

Remuneration for Directors

Remuneration for Directors is designed in such a manner that values can be shared with the shareholders and the level is appropriate for their duties. Due consideration is given to incentives for continued improvement of corporate performance and securing of talented human resources.

- ・Remuneration for Directors who are not Audit & Supervisory Committee Members consists of fixed compensation (“Fixed Compensation”), short-term performance-based bonuses (“Bonuses”) and mid- to long-term performance-based stock compensation (“Stock Compensation”). Bonuses or Stock Compensation may not be paid to Directors who serve as executive directors of the Company's subsidiaries, considering the remuneration paid by such subsidiaries and their responsibilities in the Company.

- ・Remuneration for Outside Directors consists of monthly Fixed Compensation, considering their supervisory roles and independency.

- ・No retirement benefits are paid to any Director.

- ・The amounts of remuneration for Directors are based on broad consideration of factors including the Company's performance of and the compensation standard of other companies.

- ・Fixed Compensation is determined according to responsibilities of each Director.

- ・Bonuses are cash compensation based on short-term business performance and are aimed at improving the Group's business performance for each fiscal year covered in the medium-term management plan. The target performance indicator for Bonuses is consolidated operating profit before amortization set in the 2026 Medium-Term Management Plan. Bonuses are paid according to the degree of achievement, specifically, by zero (0) times (if achievement rate is less than 60%) to two (2) times (if achievement rate is 140% or more) the predetermined base amount set according to responsibilities of each Director.

- ・Stock Compensation is non-cash compensation based on mid- to long-term business performance and is aimed at improving then Group's business performance for the three fiscal years covered in the medium-term management plan. The performance indicators for Stock Compensation are consolidated net sales outside new business domain (30%), net sales in new business domain (30%) and ROIC before goodwill amortization (40%) out of the performance targets set in the 2026 Medium-Term Management Plan. According to the achievement rate of the predetermined performance target set for each of the three fiscal years concerned, the Company distributes its shares corresponding to zero (0) times (if achievement rate is less than 60%) to two (2) times (if achievement rate is 140% or more) the predetermined basic points which are set according to the responsibilities of each director. The distribution weighing is 20% in the first year, 30% in the second year, and 50% in the final year of the 2026 Medium-Term Management Plan period.

- ・The ratio between the base amount of cash compensation (Fixed Compensation and Bonuses) and that of Stock Compensation for the President & Representative Director is set approximately at 70% and 30% respectively. The ratios for other directors are determined accordingly, based on the responsibilities of each director and general compensation standard.

- ・The ratio between the base amount of Fixed Compensation and that of performance-based compensation (Bonuses and Stock Compensation) for the President & Representative Director is set approximately at 40% and 60% respectively. The ratios for other Directors are determined accordingly, based on the responsibilities of each Director and general compensation standard.

As for Stock Compensation, the Company distributes shares equivalent to the points calculated based on the Share Distribution Regulations as resolved by the Board of Directors upon confirmation by the Compensation Advisory Committee.

Remuneration for Directors who are Audit & Supervisory Committee Members consists of monthly Fixed Compensation only, as they serve mainly with audits and supervision of corporate management. The amount for each Director who is an Audit & Supervisory Committee Member is determined by deliberations of the Audit & Supervisory Committee Members within the ranges approved at a general meeting of shareholders.

| Category |

Total amount of remuneration

(million yen)

|

Amount of remuneration by category (million yen) |

Number of eligible persons

|

||

|---|---|---|---|---|---|

| Fixed compensation |

Performance-based bonuses

|

Performance-based stock compensation

|

|||

|

Directors who are not Audit & Supervisory Committee Members

(including Outside Directors) |

338 (36) |

151 (36) |

134 (-) |

52 (-) |

9 (3) |

|

Directors who are Audit & Supervisory Committee Members

(including Outside Directors)

|

37 (16) |

35 (16) |

- | - | 5 (3) |

- 1.The remuneration for Directors who are not Audit & Supervisory Committee Members for FY2023 includes the remuneration paid to two Directors who retired at the conclusion of the 77th Ordinary General Meeting of Shareholders held on June 23, 2023.

- 2.The amounts paid to Directors who are not Audit & Supervisory Committee Members do not include employee salary portions for Directors who have concurrent responsibilities as employees.

- 3.Performance-based Stock Compensation for FY2023 are paid to five executive Directors who are not Audit & Supervisory Committee Members (excluding Outside Directors). Bonuses have not been paid to one (1) Director concurrently serving as a director of subsidiaries, considering the remuneration paid by such subsidiaries and their responsibilities in the Company. The amount of performance-based Stock Compensation refers to grant allowance for the current fiscal year.

Policy for Training of Directors

It is the Company’s basic policy to appropriately provide Directors with training as are necessary and on a regular basis for them to fulfill their respective roles and responsibilities. Directors acquire, update, and develop necessary knowledge through in-house training and/or seminars by Tokyo Stock Exchange and other workshops given by outside professionals such as lawyers and other subject matter experts, as necessary. Opportunities such as factory tours and on-site visits in the Company and its subsidiaries are also given for them to refine their knowledge and understanding towards the Group’s business, finance, and structures.

Corporate Governance Report

Evaluation on Effectiveness of the Board of Directors

The Company has conducted an annual analysis and evaluation of the effectiveness of its Board of Directors based on its Corporate Governance Guidelines since fiscal year 2015, thereby endeavors to strengthen the function of the Board of Directors as a whole.

Adobe Reader