Stock Information

Stock Information (as of March 31, 2025)

| Number of shares authorized | 150,000,000 |

|---|---|

| Number of shares issued | 58,938,210 (Including 1,141,650 shares of treasury stock) |

| Number of shareholders | 16,010 |

| Fiscal year End | March 31 |

| Date of Ordinary General Meeting of Shareholders | Late June |

| Record Dates | Ordinary General Meeting of Shareholders: March 31 Year-end dividend: March 31 Interim dividend: September 30 Other such events are conducted from time to time upon sufficient notice to shareholders. |

| Trading unit | 100 shares |

| Listing | Tokyo Stock Exchange, Prime Market |

| Securities Code | 6457 |

| Method of Public Notices | The Company's method of giving public notice is by electronic notice. However, if the Company is unable to give public notice by electronic means due to an accident or other unavoidable circumstances, the same will be made by publishing in the Nikkei. https://www.glory.co.jp |

| Administrator of Shareholder Registry | Mitsubishi UFJ Trust and Banking Corporation |

Major Shareholders

| Shareholder | Number of shares held (Thousands of shares) |

Holding ratio(%) |

|---|---|---|

| The Master Trust Bank of Japan, Ltd. (Trust account) | 7,997 | 13.8 |

| Nippon Life Insurance Company | 3,427 | 5.9 |

| Custody Bank of Japan, Ltd. (Trust account) | 2,610 | 4.5 |

| Glory Group Employees' Stock Ownership Association | 2,582 | 4.5 |

| The Master Trust Bank of Japan, Ltd. (ESOP account 75838) | 1,618 | 2.8 |

| Tatsubo Fashion Co. Ltd. | 1,500 | 2.6 |

| Glory Business Partners' Stock Ownership Association | 1,165 | 2.0 |

| Sumitomo Mitsui Banking Corporation | 1,100 | 1.9 |

| STATE STREET BANK AND TRUST COMPANY 505103 | 896 | 1.6 |

| THE BANK OF NEW YORK MELLON 140044 | 797 | 1.4 |

* The Company holds 1,141,650 treasury shares, however, they are not included in the above list.

* Percentage of total issued shares is calculated by excluding the Company's treasury shares.

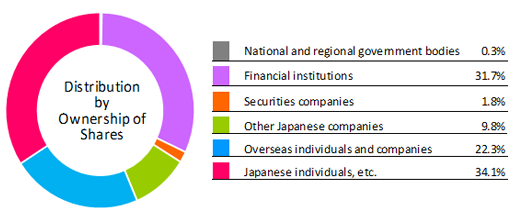

Shareholder Distribution

The Articles of Incorporation

Dividend Information

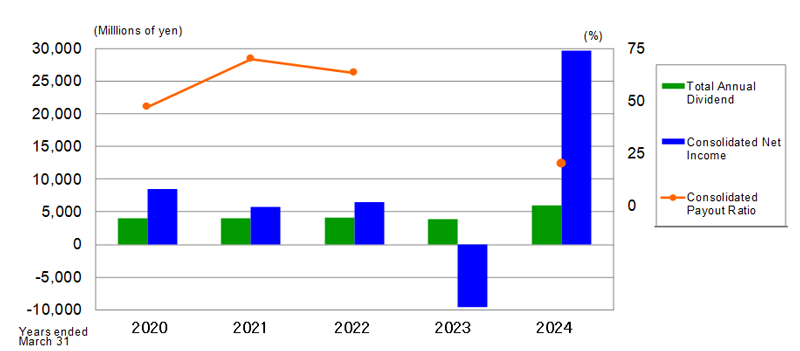

Returning profits to shareholders is an important management priority for the Company. We therefore set out the basic policy for the period of the Company's 2026 Medium-Term Management Plan to pay stable dividends, while balancing our investment for future business growth and maintaining financial position. Under this policy, we aim to pay progressive dividends using the annual dividend paid for the fiscal year ended March 2024 (106 yen per share) as a standard, while achieving a DOE (Dividend on shareholders' Equity) of 3.0% or more. Furthermore, for the fiscal year ending March 31, 2026 and March 2027, we aim to achieve a total return ratio of 100% or more.

With regard to the future purchase of treasury shares, the Company will take the best approach, considering future business development, investment plans, the internal reserves, and performance trends. The Company's policy is to keep treasury shares within approximately 5% of total shares issued by retiring any treasury shares in excess of that amount.

| Dividends Per Share (Yen) | Time of Payment | |||

|---|---|---|---|---|

| Interim (Forecast) |

Year-End (Forecast) |

Annual (Forecast) |

Interim | Year-End |

| 56 | 56 | 112 | December 2025 | June 2026 |

| FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | |||

|---|---|---|---|---|---|---|---|

| Net income attributable to owners of parent (Millions of Yen) |

5,705 | 6,410 | -9,538 | 29,674 | 16,053 | ||

| Dividends Per Share (Yen) | Interim | 30 | 34 | 34 | 40 | 54 | |

| Year-End | 36 | 34 | 34 | 66 | 54 | ||

| Annual | 66 | 68 | 68 | 106 | 108 | ||

| Total Annual Dividend (Millions of Yen) | 4,010 | 4,132 | 3,855 | 5,942 | 6,148 | ||

| Consolidated Payout Ratio (%) | 69.9 | 63.2 | - | 19.9 | 37.5 | ||

The consolidated payout ratio for FY2022 is not stated as it is a net loss.

Adobe Reader