Activity Highlights

Self-Service Kiosks that Improve Customer Experience while Meeting

Self-Service Kiosks that Improve Customer Experience while Meeting

Labor-Saving Needs

Acrelec Group S.A.S. (Acrelec; headquartered in Saint-Thibault-des Vignes, France) has end-to-end capability encompassing the development, manufacturing, and sales of self-service kiosks*, with 19 bases mainly in Europe. Acrelec provides products and services to major fast-food chains and retailers in over 80 countries around the world.

The combination of Acrelec’ s self-service kiosks with Glory’ s coin and banknote recyclers will deliver a self-service solution that meets the needs of both cash and non-cash payments, this is expected to help save power and labor in shop management while also enhancing the customer experience. In addition, we will utilize the AI integrated into Acrelec software to collect and analyze sales data and in turn boost operational efficiency while offering a user-friendly service by displaying information optimized for each customer.

*Self-service kiosks allow users to place orders and settle accounts on their own. They have attracted attention as a means for improving operational efficiency and supporting new businesses that utilize the sales data they collect.

Cash-Out Service for Greater User Convenience and Cash Flow Efficiency

Cash-Out Service for Greater User Convenience and Cash Flow Efficiency

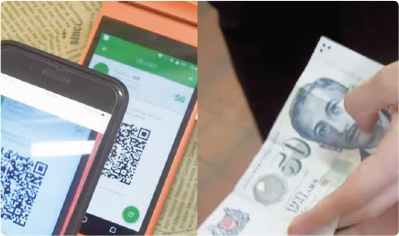

SOCASH PTE. LTD. (soCash; headquartered in Singapore) develops and provides a cash-out service that allows consumers to withdraw cash at the point of sale in retail stores. Users can withdraw cash at the nearest store instead of having to visit a financial institution. The service also allows stores to cut their cash-in-transit costs by allocating part of their sales to withdrawals and thus reducing the frequency of collections.

Our collaboration with soCash will enable us to transcend the boundaries of financial institutions and retail stores to create an efficient cash circulation cycle for society as a whole.

Users present the read-only QR code displayed on their mobile phone to withdraw cash from the cashier.

Cash Settlement Platform Generating Multiple Benefits

Cash Settlement Platform Generating Multiple Benefits

Cash Payment Solutions GmbH (CPS; headquartered in Germany) develops and provides a comprehensive cash settlement platform that uses POS registers in retail shops. Users can deposit and withdraw cash from their bank account and pay e-commerce and utility bills with cash by presenting the CPA-issued barcode at the register. Stores can expect to attract more customers and reduce cash-in-transit costs, while partner banks can offer deposits and withdrawals at a lower cost than ATMs and bank tellers. As an additional benefit of the service, e-commerce operators can attract consumers who prefer cash payments.

CPS and Glory share a common strength in networks that straddle the financial and logistics sectors. By combining CPS’ cash payment solution and Glory’s cash handling solutions, we will be able to integrate the digital society with physical cash to realize a new style of cash circulation.

Cash payment service in use